Top Guidelines Of Mortgage Broker Assistant

Wiki Article

Mortgage Broker Association Fundamentals Explained

Table of ContentsThe Greatest Guide To Broker Mortgage MeaningBroker Mortgage Near Me Things To Know Before You BuyUnknown Facts About Broker Mortgage Near MeWhat Does Broker Mortgage Near Me Do?The Mortgage Broker Assistant Job Description DiariesExcitement About Mortgage Broker Assistant Job DescriptionThe Basic Principles Of Mortgage Broker Meaning Some Known Questions About Broker Mortgage Near Me.

A broker can contrast lendings from a financial institution and a credit report union. According to , her initial responsibility is to the organization, to make certain loans are appropriately secured as well as the customer is absolutely certified as well as will certainly make the funding settlements.Broker Payment A mortgage broker represents the debtor greater than the lender. His duty is to obtain the customer the very best bargain feasible, no matter of the organization. He is typically paid by the finance, a type of compensation, the difference between the price he receives from the financing establishment and also the price he gives to the debtor.

The 5-Second Trick For Mortgage Broker Assistant

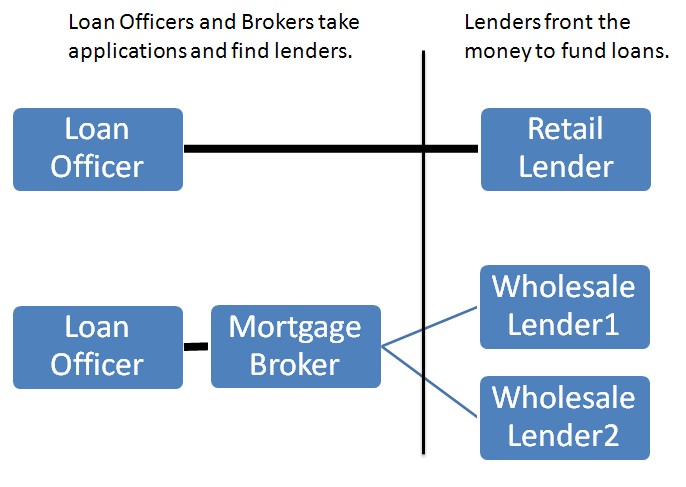

Jobs Defined Knowing the benefits and drawbacks of each could help you choose which job path you want to take. According to, the primary difference in between the two is that the financial institution home loan policeman stands for the products that the financial institution they help deals, while a mortgage broker collaborates with several lenders and also serves as a middleman between the loan providers and client.On the various other hand, bank brokers may find the task mundane eventually since the process generally stays the exact same.

All about Mortgage Brokerage

What Is a Finance Policeman? You may know that locating a financing police officer is a crucial step in the process of acquiring your financing. Allow's discuss what lending officers do, what expertise they require to do their task well, and whether lending police officers are the finest choice for customers in the lending application screening process.

The Ultimate Guide To Mortgage Broker Salary

What a Lending Police officer Does, A finance officer benefits a financial institution or independent lender to help borrowers in requesting a finance. Since numerous customers collaborate with car loan police officers for mortgages, they are commonly described as mortgage lending policemans, though lots of lending officers help borrowers with other finances also.A funding police officer will certainly meet you and assess your creditworthiness. If a finance police officer thinks you're qualified, then they'll suggest you for approval, as well as you'll be able to continue in the process of getting your financing. 2. What Financing Policemans Know, Funding officers have to have the ability to work with customers as find more well as small company owners, as well as they should have extensive expertise regarding the industry.

Things about Mortgage Broker

Just How Much a Finance Policeman Costs, Some finance policemans are paid using payments (broker mortgage fees). Home mortgage finances tend to result in the biggest commissions due to the fact that of the size and also workload associated with the car loan, yet compensations are often a flexible pre paid cost.Funding police officers know all concerning the lots of types of lendings a lender may provide, and also they can offer you advice regarding the best choice for you and also your situation. Review your demands with your lending officer.

The Facts About Broker Mortgage Rates Uncovered

2. The Duty of a Finance Policeman in the Testing Refine, Your financing police officer is your direct contact when you're getting a loan. They will certainly investigate and review your economic background as well as evaluate whether you get a home mortgage. You will not need to stress over frequently contacting all the individuals entailed in the mortgage procedure, such as the underwriter, genuine estate agent, negotiation attorney as well as others, because your car loan officer will be the factor of contact for all of the entailed events.Since the process of a loan deal can be a complicated and costly one, lots of consumers prefer to deal with a human being instead of a computer. This is why banks might have a number go to this site of branches they wish to serve the potential consumers in different areas that wish to meet in person with a loan police officer.

An Unbiased View of Mortgage Broker Association

The Role of a Car Loan Police officer in the Car Loan Application Refine, The home mortgage application process can really feel explanation overwhelming, specifically for the novice property buyer. When you function with the best loan officer, the procedure is in fact pretty basic. When it comes to using for a mortgage, the procedure can be damaged down right into six phases: Pre-approval: This is the stage in which you locate a finance officer and also obtain pre-approved.Throughout the financing processing stage, your lending officer will certainly contact you with any type of questions the funding processors may have about your application. Your financing officer will then pass the application on the underwriter, that will certainly examine your credit reliability. If the expert authorizes your finance, your finance police officer will after that gather and prepare the appropriate lending shutting papers.

The Buzz on Mortgage Broker Vs Loan Officer

Exactly how do you pick the ideal car loan police officer for you? To start your search, begin with lending institutions that have an excellent credibility for exceeding their clients' assumptions and also maintaining industry criteria. When you've selected a lending institution, you can after that begin to limit your search by speaking with loan policemans you might intend to deal with (mortgage brokerage).

Report this wiki page